Biswap DEX is opening up a world of possibilities. With its AMM V3 feature, it is introducing some major transformations that will have a ripple effect throughout the entire Biswap platform. To ensure everyone is informed of the changes and new features coming their way, the Biswap team is here to provide you with the essential details.

Questions from the Biswap community will be answered in this article. We will look into the commonly asked queries and provide the necessary information.

- What will happen with existing earning tools and products?

- What lock instrument will be implemented on Biswap V3?

- Will there be a burn mechanism on Biswap V3?

- How will the trading fee be distributed on Biswap V3?

The Biswap team has been putting in a lot of effort to create new products that will make project operations on AMM V3 and BSW more efficient and increase the utility of the market. These items will serve as an improved substitute for current income-generating tools, granting our customers rewarding returns.

The new lock mechanism utilizes the best features available and provides some unique advantages, such as Real Yields in USDT and other benefits. This intricate idea necessitates alterations in the BSW emission fee distribution and trading. It is an imperative approach that allows for a temporary halt in the burning of BSW and decreases the BSW supply circulation more effectively.

Note:The primary goal of this article is to explain to our users a core idea of upcoming changes on the Biswap platform and the concept of the new BSW lock mechanism. Therefore, all the numbers, percentages, and periods are conditional and may be changed. Consider that all the aspects are interdependent. Therefore it is important to read the whole article to understand the ties, as every feature plays a strategic role.

BSW Investment Pool | New Lock Mechanism for Emission Reduction

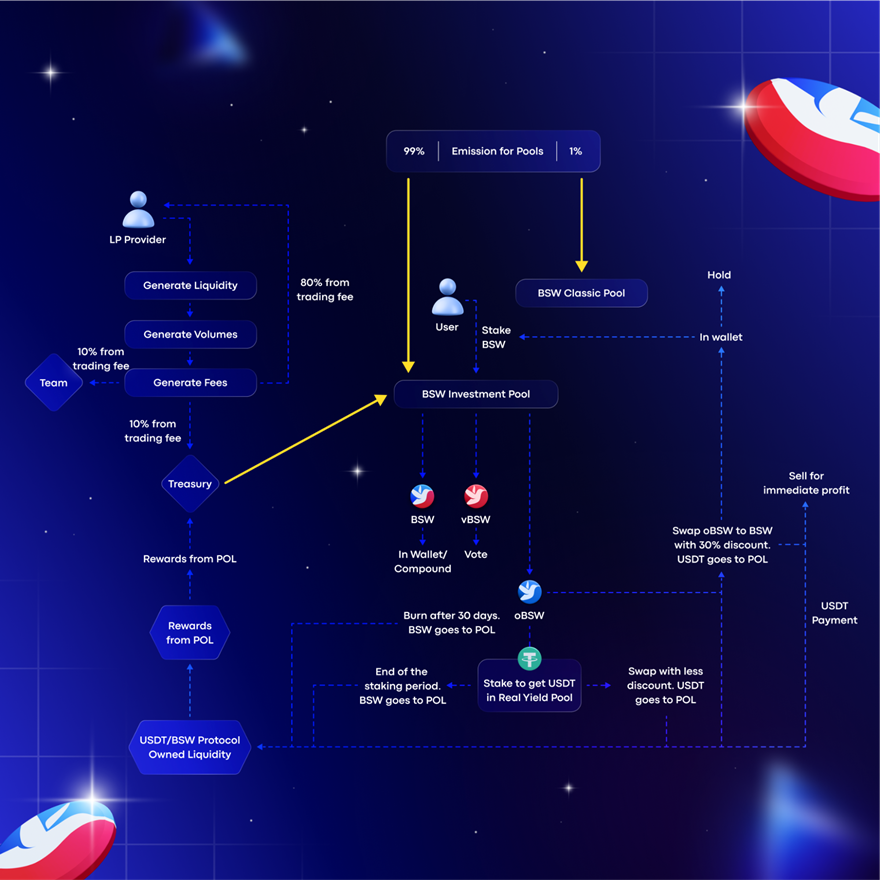

Biswap DEX has devised a new lock mechanism to decrease the circulation supply of BSW tokens. This is to ensure that the value of the native token remains stable and to establish the Biswap Protocol Own Liquidity (POL) pool. This pool enables the transition from an inflationary model to a self-sustaining system. The lock mechanism involves the introduction of several new products, changes to the trading fee distribution and a modification to the BSW emission rate.

The Biswap team will ask its users to cast their votes in order to reach a consensus on reducing BSW emissions and launching a lock mechanism. This will require making changes to the Biswap environment that all parties agree upon.

Note: If the Biswap team, together with the community, decides to reduce the BSW emission due to the strategic goals mentioned above, this BSW reduction per block will be gradually implemented.

Biswap Plans due to the New BSW Emission Distribution

99% of the share of the BSW emission that is directed to the pools, will be directed to the BSW Investment Pool and 1% to the BSW Classic Pool. These percentages may be changed according to the market conditions and tendency.

BSW Investment Pool Concept

The BSW Investment Pool will be an integral part of the Biswap platform. It is a money-making feature that will be made available shortly after the launch of the AMM V3. This will provide BSW holders with a beneficial way to increase their funds through a range of options.

The Investment Pool of BSW encourages people to place their BSW tokens in reserve and receive a variety of benefits in return. The more BSW tokens are held, the greater the rewards and the more value they gain.

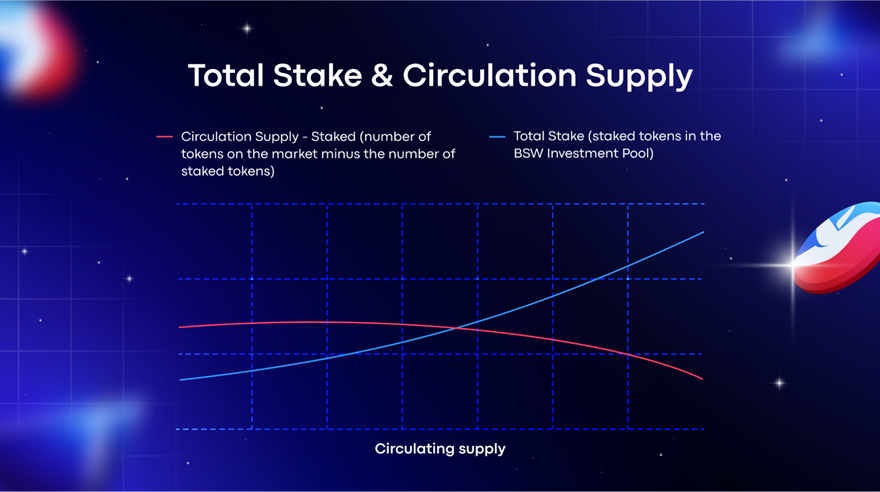

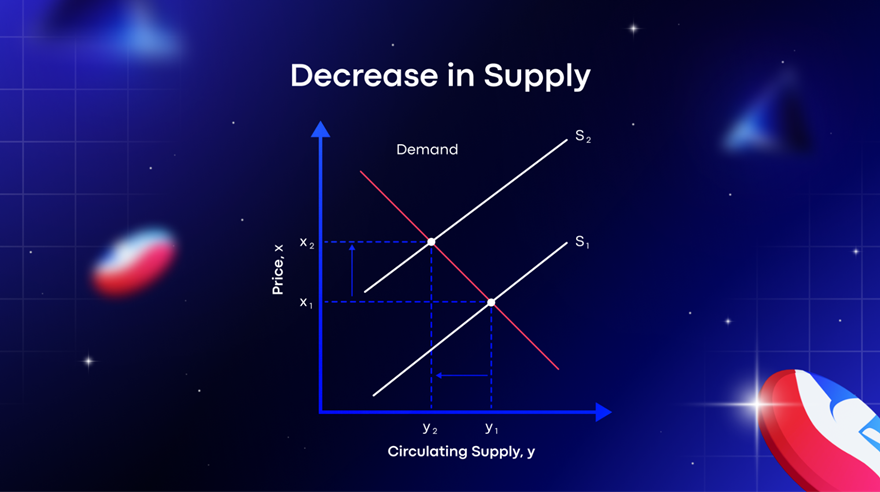

When BSW is locked into the Investment Pool, the amount of BSW in circulation diminishes. As the supply of BSW decreases, the pressure on the BSW price will be reduced, depending on the demand for the token on the market.

Goals of BSW Investment Pool

- Increase BSW token value, gradually reducing BSW emission and completely stopping it as a result

- Decrease the pressure on the BSW token price

- Create a Protocol Owned Liquidity (POL)

- Maintain a higher number of BSW on the platform Ensure Real Yields in USDT for users

Discover BSW Investment Pool Benefits

- Diversal Form of Rewards: Staking into the BSW Investment Pool brings BSW tokens, oBSW points, and vBSW points to the users. BSW token serves as passive income, vBSW points give voting power, and oBSW points provide users with a few options to earn more: buy BSW with a discount and access to the Real Yield Pool.

- Unique Access to Real Yield Pool: Only users participating in the BSW Investment Pool can stake oBSW points in the Real Yield Pool and earn USDT.

- Flexible Lock Terms: Users can lock BSW for 4 different lock terms. It is possible to make different deposit positions simultaneously applying your own strategy.

- Higher APRs for Long-term Investors: The longer lock terms users choose, the higher APRs they will get.

- New Utility for BSW Holders: vBSW and oBSW points open new ways to take advantage of BSW holding.

BSW Investment Pool Lock Periods

Users have 4 lock term options to stake BSW tokens: 3, 6, 9, and 12 months. It is possible to stake BSW for different lock terms at the same time. During the lock periods, users will get rewards in BSW, vBSW, and oBSW. Chosen lock term determines the APR of the BSW reward, oBSW, and vBSW multiplier. In case of early withdrawal, a 50% penalty fee from the withdrawal deposit will be charged, while earned BSW will be directed to the user's wallet in full amount.

Note: Exact numbers will be provided closer to the release date.

After the end of the lock term, the rewards allocation stops, and users will have a few options:

- unstake the deposit and get the locked BSW deposit + BSW rewards in their wallet;

- continue to stake, choosing one of the lock terms;

- add more BSW to deposit and continue to stake, choosing one of the lock terms.

Early Withdrawal

If users decide to withdraw the deposited BSW earlier than the lock term, a 50% penalty fee will be applied. The charged BSW as a penalty fee will be directed to the POL.

Penalty Fee Examples

Full withdrawal

The user has staked 1000 BSW into the BSW Investment Pool for a 3-month lock term. They decide to withdraw the entire crypto deposit after the 2nd month. 50% (500 BSW) of the 1000 BSW is charged as a penalty fee for the early withdrawal. The user receives a 500 BSW + earned BSW amount in their wallet.

Partly withdrawal

The user has staked 1000 BSW into the BSW Investment Pool for a 3-month lock term. They decide to withdraw only part (500 BSW) of the deposit after the 2nd month. 50% (250 BSW) of the 500 BSW is charged as a penalty fee for the early withdrawal. The user receives a 250 BSW + earned BSW amount in their wallet. 500 BSW are left in the pool.

Rewards in BSW Investment Pool | Accrual, Use & Burn

BSW Investment Pool will reward its users with a few types of rewards with different values and ways of use: BSW, vBSW, and oBSW.

BSW | Rewards in Biswap Native Token

BSW rewards are allocated in BSW tokens, and their distribution depends on the APRs according to the lock term. Harvest and compound functions will be available in the pool, and all the details will be published closer to the release date.

vBSW | The Power for Your Votes

The vBSW is a unit of measure that represents voting power and will be used by Biswappers to participate in voting once the BSW Investment Pool gets released. (In the current voting concept, the number of staked BSW in the BSW Holder Pool, Auto BSW Pool, Earn BSW Pool, and number of BSW locked in BSW-USDT, BSW-BNB pairs represents users' voting power).

vBSW Accumulation

The vBSW accrual depends on the number of staked BSW into the BSW Investment Pool and the particular multiplier corresponding to the chosen lock term. The longer the lock term, the higher the multiplier and the more vBSW (voting power) users get.

Note: If a user has a few positions in the BSW Investment Pool (Staked BSW for different lock terms), the vBSW from their different positions will be summed up.

oBSW | oToken Crucial Role in a Biswap V3 Ecosystem

oBSW is an option point that is given to BSW Investment Pool users. Each oBSW is backed up with a real minted BSW stored on a separate contract. The accrual of oBSW points takes place every block and starts from the moment of the deposit. The percentage of oBSW points allocation depends on the share of the user's deposit relative to other locked BSW in the BSW Investment Pool.

Note: oBSW points allocation is equal to the BSW rewards allocation, but this ratio may be changed in the future.

2 Options of the oBSW Usage

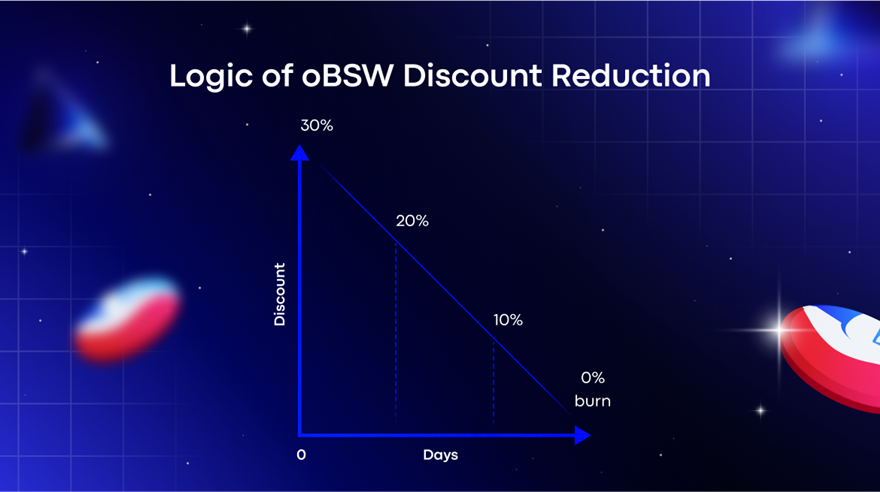

- Use oBSW points to get real BSW for USDT with a 30% discount (BSW purchasing with a discount is only possible with USDT). The number of oBSW points corresponds to the number of real BSW that users can buy for USDT.

- Stake oBSW points into the Real Yield Pool to get USDT within a particular staking period.

The 'Stake oBSW' option does not cancel the discount option. If users stake oBSW points into the Real Yield Pool, the discount amount for option 1 will linearly decrease daily from 30% to 0% during the n-days. It means that users can use their locked oBSW in the Real Yields Pool to buy BSW with a discount. Consider that using a part of oBSW points is impossible, only the whole oBSW on balance.

oBSW Burning | BSW Contribution to POL

All the oBSW is backed up with real minted BSW tokens. While the oBSW points are burning, the BSW tokens are sent to the Protocol Liquidity Pool (POL). These two processes are parallel but separate and do not affect each other.

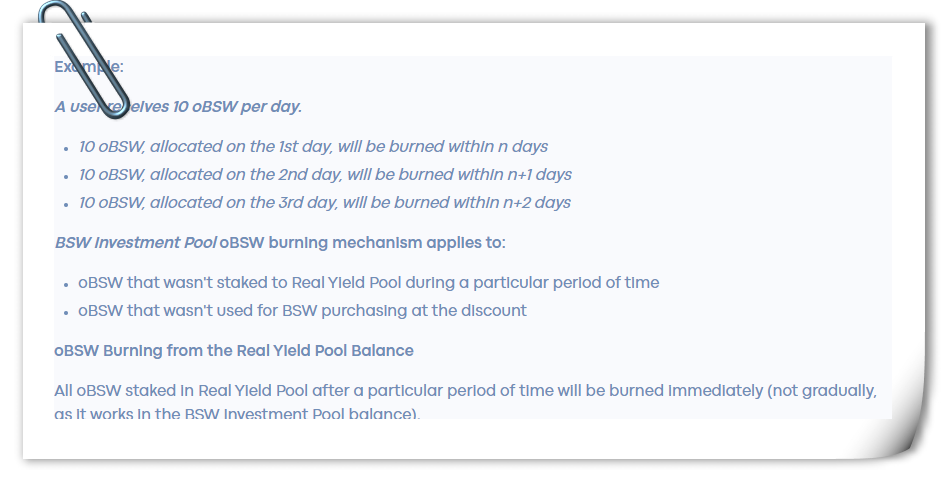

There are two different stages of oBSW burning. The 1st stage considers oBSW that is stored on the BSW Investment Pool balance. The 2nd stage considers oBSW that is stored on the Real Yield Pool balance.

oBSW Burning from the BSW Investment Pool Balance

After the user staked into the BSW Investment Pool, within the n-day period, the allocated oBSW will start to burn day by day according to the daily oBSW rewards distribution.

Real Yield Pool | Income in USDT & Discount for oBSW Swap

Real Yield Pool is a unique opportunity on the DEX market to earn Real Yields.

Real Yields are rewards in USDT stable tokens for staking oBSW into the BSW Investment Pool. Real Yield rewards are generated from a certain percentage of the real income of the platform instead of native token emission. Thus, this approach will strengthen BSW value and stable rewards for the pool's users.

Real Yield Pool Benefits

- Up to 30% discount for BSW purchasing

- Real Yield in USDT tokens

Once users staked oBSW into the Real Yield Pool, rewards in USDT start to accumulate. At the same time, users still have a chance to use oBSW in order to buy BSW at a discount(which is decreasing daily). If they choose to do so, USDT rewards are ceased.

Note that oBSW points staked into Real Yields Pool bring profit for a certain period of time and get burned after that. It is necessary to stake a new oBSW to continue earning USDT from the Real Yields Pool.

What is the Real Yields Source?

Treasury is a separate contract that allocates 10% from the V3 trading fee, the share of POL (Protocol Own Liquidity) rewards, and future revenue streams.

Treasury ensures the Real Yields rewards for Real Yields Pool users. The share of Treasury that will be directed to Real Yields rewards will be determined by the Biswap team to maintain the particular APR in the Real Yields Pool.

V2 vs V3 Trading Fee Distribution (Regular Swaps)

Biswap POL | Protocol Own Liquidity

Protocol Owned Liquidity (POL) model refers to an approach in which a DeFi protocol owns and controls a certain amount of liquidity in its ecosystem. Biswap POL - BSW/USDT liquidity that belongs to the Biswap DEX. The protocol itself holds and manages token reserves instead of relying solely on external market participants to provide liquidity.

POL Rewards

Once Biswap owns a liquidity pool, it receives LP rewards as a Liquidity Provider. These rewards will bring income to the project. The percentage of this income will be directed to ensure the Real Yields rewards.

Biswap POL Goals

- Ensure constant liquidity and BSW stability on the market.

- Decrease pressure on BSW price thanks to enlarged BSW/USDT liquidity.

- Reward users with Real Yield from the POL instead of emission (a share of POL tokens is directed to the Treasury)

How will POL be formed?

POL replenishes with two tokens, BSW and USDT, through oBSW staking and exchange mechanics.

BSW: once the oBSW points burn, the backed-up BSW tokens are sent to the POL.

BSW: once the 30% discount for the oBSW exchange gets to 0% in the Real Yield Pool, the backed-up BSW are sent to the POL.

BSW: BSW charged as a 50% penalty fee for early withdrawal and consequently directed to the POL.

USDT: when users exchange oBSW to backed-up BSW at a 30% discount through the BSW Investment Pool, they pay USDT, which is sent to the POL.

USDT: when users exchange oBSW to backed-up BSW at a discount through the Real Yield Pool, they pay USDT, which are sent to the POL.

BSW Classic Pool

BSW Classic Pool is one more way to earn from BSW staking. It is separate from the BSW Investment Pool and will be formed of the 1% from the BSW emission.

Benefits of BSW Classic Pool:

- Stake BSW with no lock term

- Get BSW rewards

- Gain vBSW (voting power)

Full Picture of New BSW Lock Mechanism | Sumup

The new BSW lock mechanism is a conceptual modification requiring complex changes that will benefit the Biswap platform and its users.

Main Takeaways

- BSW emission distribution will be directed to the BSW Investment Pool and BSW Classic Pool.

- BSW Investment Pool will have various lock terms and reward its users with 3 types of rewards: BSW rewards (BSW tokens), vBSW ( voting power), oBSW (optional points).

- Real Yield Pool is a part of the BSW Investment Pool that allows its users to get rewards in USDT.

- BSW Classic Pool is a separate pool with no lock term. Users will be able to get BSW rewards and vBSW (voting power).

- Biswap POL (Protocol Own Liquidity) - BSW/USDT liquidity that belongs to the Biswap DEX.

- Treasury is a separate contract that ensures the USDT rewards for Real Yields Pool users, which gets refilled with the share of POL rewards and 10% from the V3 trading fees.

What about Burn? | New Technological Solution

While DeFi is developing, structural shortcomings, such as the instability of liquidity and revenue, are becoming more visible. So, DeFi 2.0 projects seek to use new approaches to ensure the stability and development of the ecosystem, which go far beyond just burning tokens.

There are other tools that DeFi projects consider to provide stability, manage risks, and encourage users' participation, such as:

- smart management of tokenomics;

- usage of lock instruments;

- decentralized funds;

- automatic backup protocols.

Integrating a token lock mechanism, meaning BSW Investment Pool, will encourage participants to hold BSW tokens for a certain period, which in turn will ensure greater price stability and eliminate short-term speculative behavior. Also, the creation of an innovative protocol-owned liquidity (POL) model at Biswap will address the liquidity instability.

From Token Burn to BSW Lock Instrument on Biswap

Like any growing project, the Biswap DEX prioritizes new tools to power up its ecosystem and native token value. We aim to reduce BSW circulation and create the protocol's liquidity, which meets the DeFi 2.0 concept.

Burn as a tool for reducing the total supply is effective when more tokens are burned relative to the tokens that enter the market through emission. The current BSW token burn reduces BSW circulating supply but does not affect the liquidity of the DEX.

Therefore burning contradicts our aim to reduce BSW circulation and create the protocol's liquidity (POL), which entails the goal of moving away from inflationary models to a self-sufficiency one.

Reducing the BSW emission by launching the BSW Investment Pool and pausing a regular BSW token burn (sending tokens to the dead address) is necessary to change the current state. This burning pause will continue till BSW emission gradually decreases to 0 as a result. Once BSW gets to the point, turning the BSW burn mechanism back will be efficient, which will directly reduce the token's total supply.

Note: the last BSW burn will be held as planned in Q3 of 2023.

Why Can't BSW Burn & BSW Investment Pool Function Simultaneously?

In the case of executing a burn along with token minting enabled, the circulating supply grows faster than the total supply decreases, ultimately leading to this model's inefficiency at the current stage of the project's development.

Instead, the best option is to reduce the circulation supply (which is a part of the total supply) by using token lock mechanisms (BSW Investment Pool) and building deflationary models based on Real Yield and Protocol Owned Liquidity. Instead of burning the intended tokens, which causes token inflation, these instruments solve the problem of token value dilution.

Existing Product Functioning along with V3 AMM Protocol

AMM V3 is a historical swing for the Biswap DEX platform that will bring unique opportunities. Therefore a range of changes will be implemented according to some existing Biswap products: Launchpools, Referral Program, Fee Return, and Expert Mode.

Note: V2 Products closure will be conducted gradually, and you will be able to withdraw and restake your funds on time.

Staking

BSW Investment Pool, Real Yield Pool, and BSW Classic Pool are the alternatives to existing staking features on Biswap!

- All the Double Launchpools will be turned off after the AMM V3 release and move to the 'Inactive section'. Since the pool is in the 'Inactive section', it is easy to withdraw the rewards and deposit crypto quickly.

- A Multi-reward Pool will be turned off after the AMM V3 release. The Multi-reward Pool closure will be conducted similarly to the NFT Staking closure, so users will be informed in advance and can withdraw their funds on time.

- BSW Manual Pool, BSW Auto Pool, and BSW Holder Pool rewards influx will start to decrease after the BSW Investment Pool release. When the rewards are distributed entirely, these pools will be transited to the 'Inactive section'.

Note: a commission for early withdrawal for BSW Auto Pool and BSW Holder Pool will be turned off once BSW Investment Pool gets released to ensure the convenient transition to the new staking products.

Multi-type Referral Program

The Referral Program is contrary to the primary goal of the new BSW lock mechanism - decrease emission and increase BSW value. Therefore the functionality of the Referral Program will be changed after the AMM V3 release due to the latest calculations inside the Biswap platform.

After the AMM V3 release Referral Program won't be applied to Swaps and Farms but will remain active for the BSW Manual Pool until the BSW Investment Pool release.

Fee Return

Fee Return will continue to function as usual after AMM V3 release in case of trading through V2 routes. After the BSW Investment Pool release, the Fee Return function will be turned off because it does not correspond to the new BSW lock mechanism.

Expert Mode

The existing Expert Mode was developed according to the V2 AMM functionality. For this reason, it will be temporarily turned off for the modification process and adaptation to V3 AMM.

Closing Word

Biswap was happy to present you with future strategic solutions. All the updates and new features are directed to strengthen the BSW token and provide Biswap users with efficient and worthy income.

BSW Investment Pool will be a reliable and long-term earning feature for users and a key product for the entire Biswap ecosystem. As a new BSW lock mechanism, it will maintain interest in the Biswap platform and BSW token through the profitable conditions and opportunities to apply a unique holding strategy for each user.

The Real Yield model will be a remarkable feature among other DEX on V3. Only BSW investment Pool users will be able to get oBSW that can be used in different ways: staking to get USDT rewards and exchanging them for BSW tokens.

These and other features will complement a sustainable platform operation. Stay tuned for more details, and get ready for a new era on Biwap DEX!

HYIPer.net » Biswap Official News: Upcoming Product Updates & New Lock Mechanism